Medium-Term Business Plan

A business plan aimed at sustained growth

into our 150th anniversary in 2028 and beyond

Ashimori Group Road to 150

Medium-Term Business Plan

FY2026.3–FY2028.3 (126th–128th Fiscal Terms)

- Business Strategy

- Automotive Safety Systems High Performance Products

- Laying the groundwork for further growth

- Financial and Investment Strategy Innovation Strategy Human Resource Strategy ESG Strategy

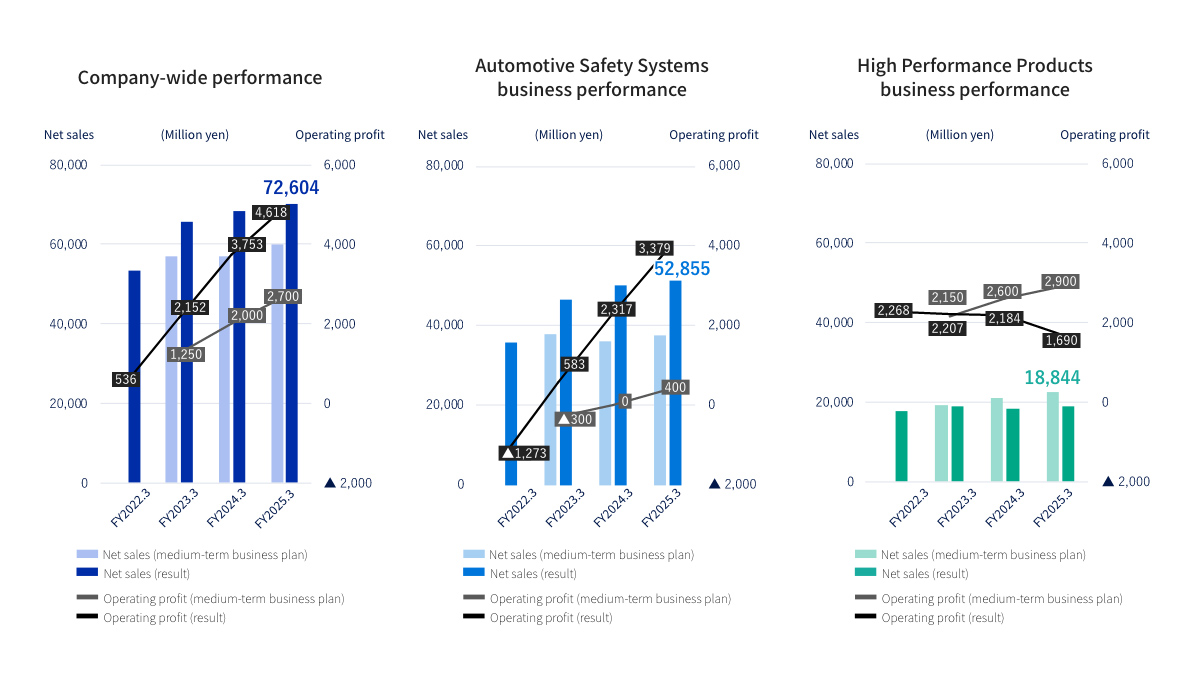

Progress of the Previous Medium-Term Business Plan (FY2023.3–FY2025.3)

• As a company, we achieved the numerical targets of our medium-term business plan.

• Our Automotive Safety Systems business saw a significant increase in performance due to the results of collaboration with Toyoda Gosei and the favorable impact of the weak yen.

• Our High Performance Products business did not achieve its numerical targets, but it remained almost unchanged.

Business performance

Numerical target achievement status

| Medium-Term Business Plan | FY2025.3 result | Evaluation | |

|---|---|---|---|

| Net sales | 60 billion yen | 72.6 billion yen | ◯ |

| Operating profit | 2.7 billion yen | 4.6 billion yen | ◯ |

| Net income | 2 billion yen | 2.7 billion yen | ◯ |

| ROIC | 6.3% | 7.6% | ◯ |

| Equity ratio | 40% or more | 45.9% | ◯ |

| Dividend per share | 100 yen | 100 yen | ◯ |

◯ - Achieved or realized

Results of collaboration with Toyoda Gosei

- ■ Improved productivity thanks to TPS (Toyota Production System)

- ■ Improved product competitiveness thanks to technological and personnel exchange

- ■ Cost reduction thanks to supply chain integration and sharing

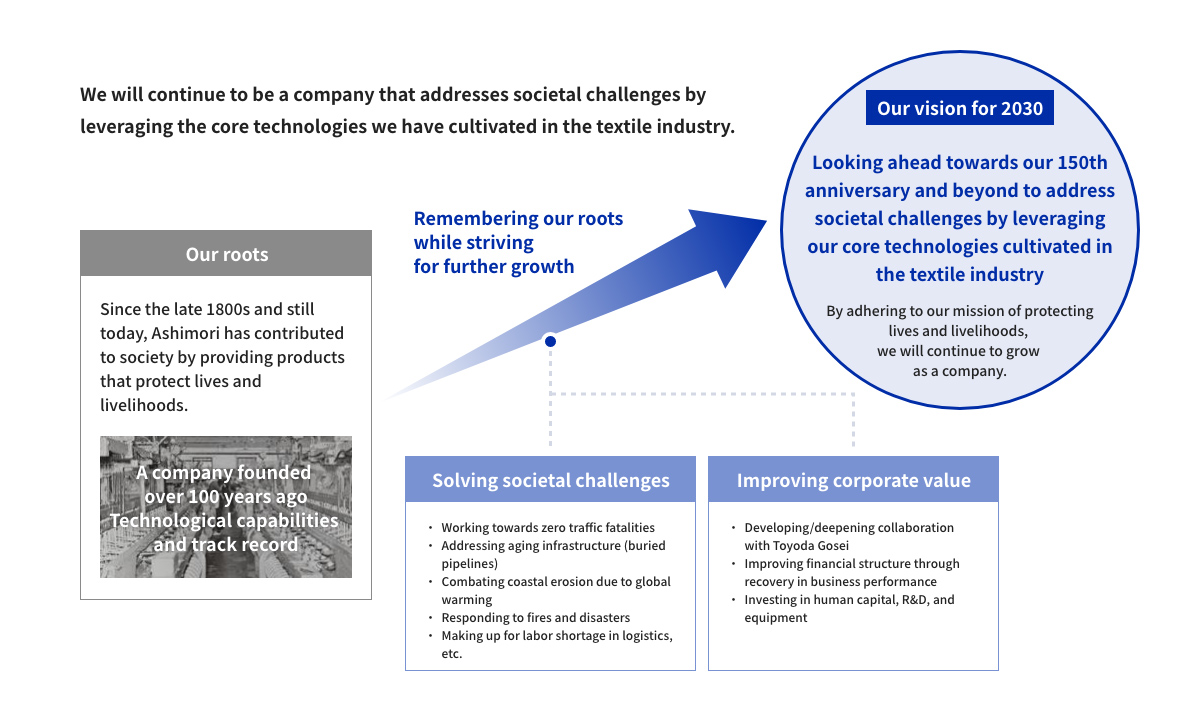

Our Vision and Outline of “Road to 150”

Message from the President

MVV (Mission, Vision, Values)

-

Mission

Our mission is to provide products that protect lives and livelihoods.

-

Vision

We will continue to be a company that addresses societal challenges by leveraging the core technologies we have cultivated in the textile industry.*

*We’ve recently updated our Vision. -

Values

We respect the rules with great integrity and work on production activities with the highest priority on quality.

Slogan

Our Vision for the Ashimori Industry of 2030

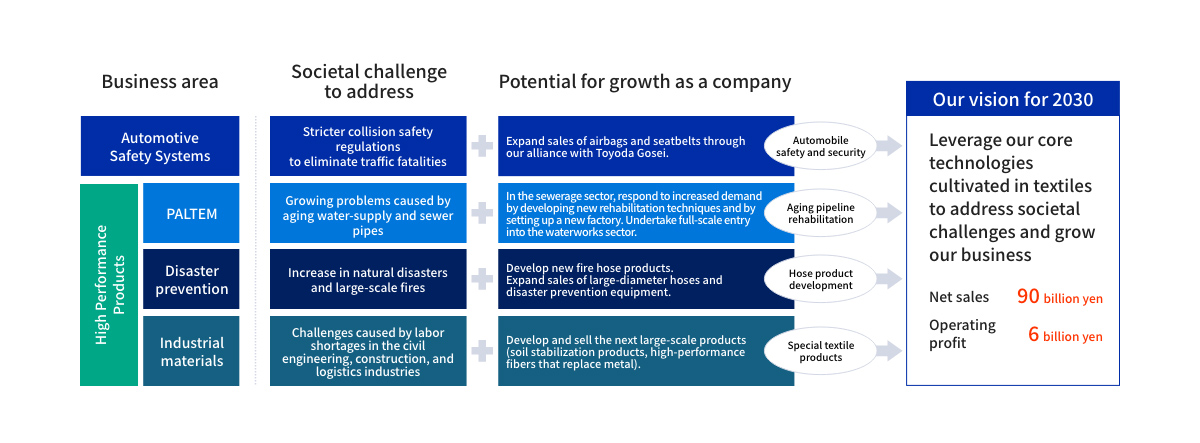

Outline of the “Road to 150” Medium-Term Business Plan

• By adhering to the company mission of protecting lives and livelihoods, address societal challenges while growing as a company.

• By leveraging core technologies cultivated in the textile industry, address societal challenges through four business areas.

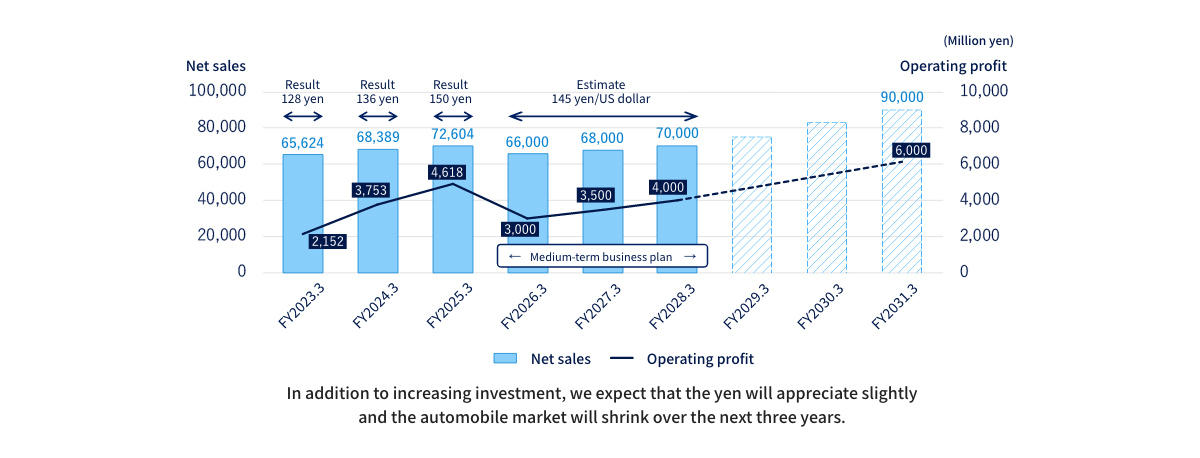

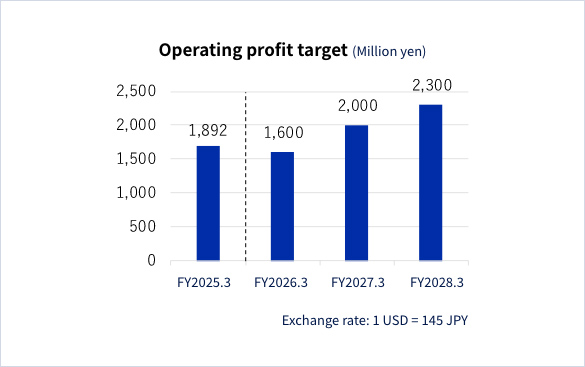

Targets of the “Road to 150” Medium-Term Business Plan

• Looking ahead to 2030, aggressively invest in human capital, R&D, and equipment.

• Use the next three years as a period for developing our business base for further growth.

Performance targets

Major targets

| FY2028.3 target | FY2031.3 target | |

|---|---|---|

| ROIC | 5.0% or more | 8.0% or more |

| Dividends | 100 yen/share or more including interim dividend and DOE of 2.5% or more | 100 yen/share or more including interim dividend and DOE of 2.5% or more |

| R&D expenses | 5 billion yen over the 3-year medium term; corresponding to 2.5% of net sales |

|

| Capital investment | 16 billion yen over the 3-year medium term | |

ROIC (return on invested capital) = Net operating profit after tax / (debt + equity)

DOE (dividend on equity ratio) = Total dividends paid / Shareholder equity

Business Strategy

Automotive Safety Systems

- Realize further global sales expansion through a wider lineup of airbags, next-generation seatbelts, and interior parts.

- Maximize the business alliance with Toyoda Gosei to strengthen our position as a collision safety systems manufacturer.

-

Our business goal

Be a strong business partner by providing the global market with unique products unlike those of any other company.

-

Analysis of the competition

- Intensifying technological competition due to legal and assessment trends and the spread of BEVs.

- Require rapid response to meet the needs to standardize products to reduce costs and to distinguish ourselves from competitors by making better products.

-

Strategy towards growth

- Achieve expanded sales in the global market through strong products that respond to customer needs.

- Evolve the value chain by pursuing even better productivity and more business efficiency.

Key measures

-

1.Product strategy

1.Product strategy

- Expand sales through entry into next-generation seatbelt market.

- Enter market for high-value-added electric sunshades.

- Expand the product lineups for door and roof sunshades and tonneau covers to meet customer needs.

- Further expand sales of airbags and seatbelts through the business alliance with Toyoda Gosei, which leverages the strengths of both companies.

-

2. Quality and manufacturing strategy

2. Quality and manufacturing strategy

- Expand quality improvement activities, including those with business partners.

- Incorporate TPS (Toyota Production System) at all bases.

- 3. Stabilize bases’ operational foundation to strengthen the sales expansion system in each market.

-

4. Human resource strategy

- Enhance training at all job levels to better educate the next generation of executives and core managers.

3-year target

High Performance Products

- In renovation of aging pipelines for the waterworks and sewerage fields, aggressively invest in sewerage and expand participation in national projects (waterworks).

- Develop new projects and expand market share in the fields of disaster prevention and industrial materials.

-

Our business goal

Develop and bring to market products and services in response to social concerns such as aging infrastructure, disaster prevention and mitigation, environmental protection, and the so-called 2024 logistics problem.

-

Analysis of the competition

- PALTEMIntensifying competition in sewerage. Barriers to entering waterworks market.

- Disaster preventionFew new market entrants, competition among limited number of companies.

- Industrial materialsMany types of products, so product differentiation and uniqueness are necessary.

-

Strategy towards growth

- PALTEMBuild system to meet growing demand in pipeline rehabilitation.

- Disaster preventionExpand products in disaster prevention, a growing market.

- Industrial materialsEstablish a new business pillar to supplement wide-woven textile products.

Key measures

-

PALTEM

PALTEM

- Sewerage:

- Boost market share by developing new rehabilitation techniques and building new factory*.

- Waterworks:

-

Expand pipeline rehabilitation business through aggressive participation in survey projects of MLIT (tie to guideline formulation)

* In Shimotsuke, Tochigi; set to start operation in spring 2027; size: 30,000 m2

-

Disaster prevention

Disaster prevention

- Expand sales of high-performance firefighting and drainage hoses.

- Boost ability to pitch our large-capacity water supply products to companies with large sites.

- Develop new materials and equipment for disaster prevention.

-

Industrial materials

Industrial materials

- Expand products such as high-value-added wide-woven textile products and labor-saving logistics products.

- Boost sales in Japan and other countries of soil stabilization products.

- Develop textile products that replace metal.

-

Human resource strategy

Human resource strategy

- Secure human resources, be more customer-oriented, boost field capabilities, and pass on skills.

3-year target

Laying the groundwork for further growth

Financial and Investment Strategy

• Shift from “defensive” investment in depreciation equivalents to “offensive” investment to build a future revenue base. Although interest-bearing debt will increase, financial soundness will be maintained with stronger shareholder equity than before.

• Stabilize shareholder returns with dividends based on DOE.

Financial strategy 3-year cash allocation

Investment strategy

Research and development| Basic policy | |

|---|---|

| Develop new fields | (1) Develop products that use lightweight fiber composite materials (2) Develop fiber sensing technology (3) Develop products that replace metals with fibers |

| Support High Performance Products business | (1) Improve weaving technology (speed, larger diameters, etc.) (2) Pursue automation and labor-saving in PALTEM production |

Growth investment budget of 8 billion yen

Investing in a new PALTEM factory and manufacturing facilities for new products in the Automotive Safety Systems business and making focused investments in core products in the disaster prevention and industrial materials business will lay the foundation for the further growth of the Ashimori Group.

Facility upgrade budget of 8 billion yen

Upgrade existing facilities at the Osaka Plant and Sasayama Plant to new ones that emphasize productivity improvement, environmental considerations, and labor savings to manufacture high-quality, high-value-added products that place priority on safety and quality.

Innovation Strategy

Pursuing product development that utilizes the core technologies of weaving/assembling, winding/fixing, plastic processing, and inflating

Product development strategy

- Automotive Safety Systems:

- Develop airbags, next-generation seatbelts, and interior products for luxury cars in cooperation with Toyoda Gosei

- PALTEM:

- Develop new rehabilitation techniques to improve work efficiency

- Disaster prevention:

- Develop new fire hose products, pursue automation/labor-saving of production lines, develop next-generation circular looms

- Industrial materials:

- Expand uses for soil stabilization products

Strategy for preliminary development and core technology development

(1) Develop products that use lightweight fiber composite materials

(2) Develop fiber sensing technology

(3) Develop products that replace metals with fibers

From approx. 3.7(FY2022–FY2024) billion yen to approx. 5.0(FY2025–FY2027) billion yen

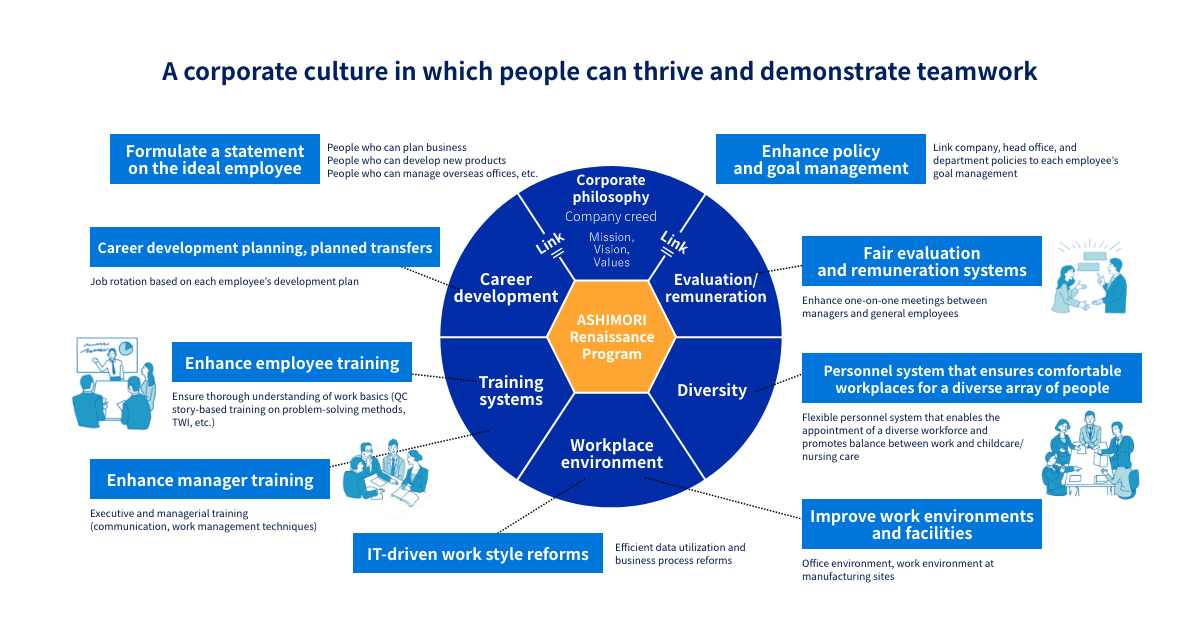

Human Resource Strategy

People are the most important management asset, and we focus on developing and securing talent.

We will implement the Ashimori Renaissance Program in order to develop a corporate culture in which people can thrive and demonstrate teamwork.

Ashimori Group HR Vision Statement

Individuals with advanced expertise and a broad perspective who can think logically and solve problems quickly

Human resource development policy

1. We will fairly evaluate people who have achieved results and people who have spared no effort.

2. We will enhance employee education and support the growth of our employees.

3. We will strive to create a comfortable workplace environment for our employees and an open corporate culture.

Ashimori Renaissance Program: Basic concept

People are the most important management asset.

We aim to develop a corporate culture in which people can thrive and demonstrate teamwork.

3 key points

Fair evaluation

Comfortable workplace environment

Enhanced training

We focus on strengthening communication between managers and general employees.

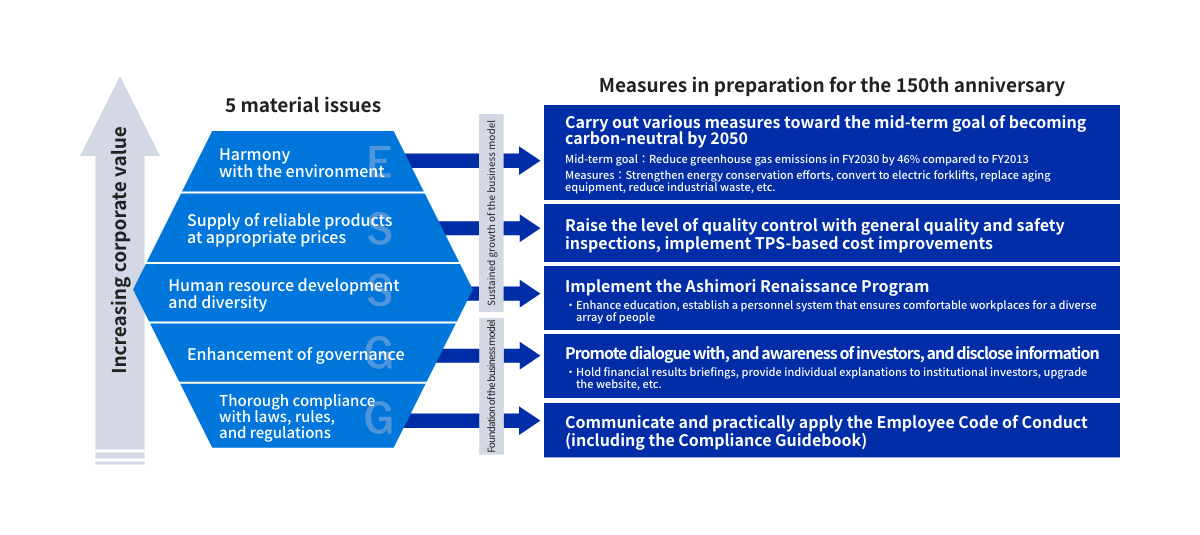

ESG Strategy

Developing ESG strategy based on materiality (key issues for sustained growth)

Sales and Operating Profit Targets by Business, Company-Wide ESG-Related KPIs*

*KPI: Key performance indicator

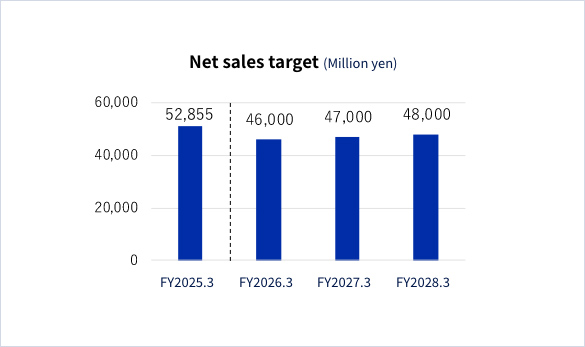

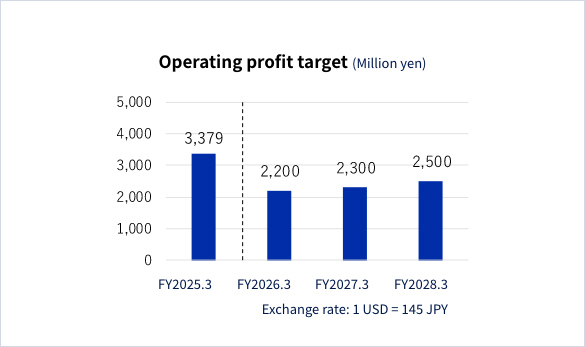

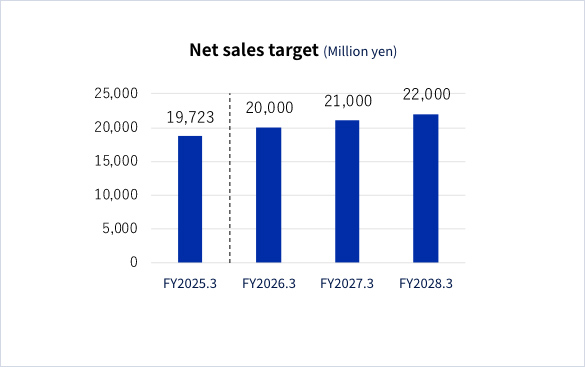

Sales and operating profit targets by business

| FY ended March 2026 | FY ended March 2027 | FY ended March 2028 | 〜 | FY ended March 2031 | ||

|---|---|---|---|---|---|---|

| Automotive Safety Systems | Net sales | 46,000 | 47,000 | 48,000 | ー | |

| Operating profit | 2,200 | 2,300 | 2,500 | |||

| High Performance Products | Net sales | 20,000 | 21,000 | 22,000 | ||

| Operating profit | 1,600 | 2,000 | 2,300 | |||

| Other revenue, head office expenses, etc. |

Operating profit | (800) | (800) | (800) | ||

| Total | Net sales | 66,000 | 68,000 | 70,000 | 〜 | 90,000 |

| Operating profit | 3,000 | 3,500 | 4,000 | 〜 | 6,000 | |

(Million yen)

Company-wide ESG-related KPIs

| Item | Current | KPI | Achieve by |

|---|---|---|---|

| Greenhouse gas emissions (consolidated, Japan) |

2% less than FY2013 levels | 46% less than FY2013 levels | FY2030 |

| Percentage of female managers | 10.5% | 15% | FY2030 |

| Men’s childcare leave acquisition rate (consolidated, Japan) |

62.4% | 90% | FY2030 |

| Percentage of women among directors | 0% | 10% | FY2030 |

See also:

Ashimori Group “Road to 150” Medium-Term Business Plan